The Ignored Lessons of the Financial Crisis

"If I told you eight years ago that America would reverse the great recession, reboot the auto industry, and unleash the greatest stretch of job creation in our history ... you might have said our sights were set a little too high." Thus boasted the former US president Barack Obama in his farewell address. But is the financial crisis really behind us? Has the strategy implemented to save the banks not, on the contrary, created the conditions for the next conflagration? Cédric Durandwrites.

An abbreviated version of this article appeared in the February 2017 Le Monde diplomatique. Translated by David Broder.

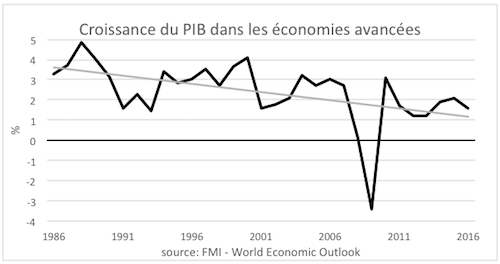

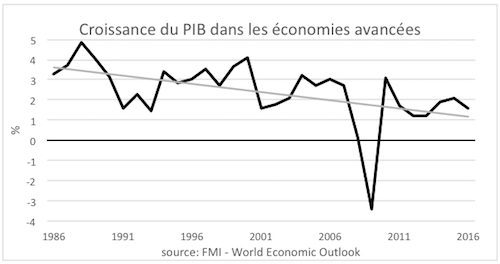

Figure 1: GDP growth in the advanced economies

Happy anniversary! On 2 April 2007, New Century Financial Corporation entered into liquidation. The collapse of this US real estate investment company — the second biggest provider of the now-infamous subprime mortgages — fired the starting gun on a financial crisis bigger than any the world had seen since 1929. Ten years on, capitalism is still yet to recover from this major shock. Growth is sluggish, under-employment endemic and the extreme monetary policies implement by central banks are reaching their limits.

Yet governments have spared no efforts. Over winter 2008–9 the authorities in the rich countries mobilised the equivalent of 50.3% of their GDP, in an emergency bid to reanimate a financial system on the brink of apoplexy.1 Recapitalising banks, exceptional loans, extra liquidity, buying up toxic assets… all budgetary and monetary channels were opened up full-flow in order to restore circulation in the financial system. Meeting for the first time as heads of state and government in Washington on 14 and 15 November 2008, the G20 decreed a general mobilisation around the slogan of restoring financial stability and saving globalisation. Reasserting their "shared belief [in] market principles, open trade and investment regimes," they committed to concerted action to avoid a repeat global crisis of similar extent.2 And to a certain extent the objectives that they set have, indeed, been achieved. The global economy has not experienced a collapse or fragmentation similar to those that marked the 1930s. Thanks to the build up of public deficits, since 2010, world GDP began growing again, and the contraction in world trade was arrested. So is neoliberalism now in the clear?

Nothing could be less certain. While capitalism has not fallen like an over-ripe apple, the system has become bogged down in stagnation. After a brief Keynesian moment in 2009, the reassertion of austerity policies and never-ending structural reforms aimed at economic liberalisation has not led to the kind of rebound in private investment that would allow the reinvigoration of economic activity. Growth in the rich countries is sluggish at around 1.5% and in heavy decline relative to previous decades (figure 1), while unemployment and under-employment remain endemic not only in Europe but also in the United States, where the proportion of the population who are in work has fallen back to 1980s levels. Unable to generate enough of an autonomous dynamic of their own, developing economies are hardly any better-fated. In 2016 China experienced its weakest growth rate since 1990s, while GDP contracted in Russia and Brazil, confirming these countries’ peripheral position in world capitalism.

The lack of a rebound after the crisis was completely unexpected. For instance, the OECD’s growth projections were systematically and massively over-optimistic.3 This persistent anomaly projects us into a novel conjuncture. Contemporary capitalism has lost its perpetual expansion dynamic, and with this its promise of a generalised prosperity. The invalidation of this first principle of its legitimation is resulting in a wide-scale political-ideological reconfiguration. Sadly for the Left, this first of all translates into the new orientation marked out by the post-Brexit British Right and, above all, the new Trump administration in the USA.

Austerity's Failure

"It's time to remember the good that government can do." This statement of Theresa May’s in her address to the Conservative Party conference on 5 October sounded the death-knell for a whole era. The new Prime Minister had not changed social allegiance — she remains firmly tied up with business circles. But she had recognised a simple fact: austerity has not brought the hoped-for recovery; giving the markets a helping hand through the massive deployment of monetary mechanisms has not worked.

Since 2010, government have put the brakes on public spending, with G7 countries drastically reducing their deficits from an average of 6.6% in 2008 to 2.7% in 2015. Erstwhile European Commissioner for Economic and Monetary Affairs Olli Rehn openly explained the then-dominant position in a column published by the Wall Street Journal: "No one can live beyond their means forever—not even governments. Both theory-based modeling and practical experience support the conclusion that stability-oriented fiscal policy is far better for growth in the medium-to-long run than a 'spend-spend-spend for growth' approach."4 Rebuffing those who warned that through austerity "Europe [was] condemning itself to a long period of slow growth and high unemployment," he declared that on the contrary it would "reinforce consumers’ and investors’ confidence, and thus turn the evident but still fragile recovery into a period of sustainable growth and job creation." As Mark Blyth has shown in a book devoted to the history of the idea of austerity, the theoretical arguments that Olli Rehn invokes do not withstand serious analysis, any more than the test of practical experience.5 Causing a certain embarrassment in academic circles, Thomas Herndon — a masters’ student at the University of Massachusetts Amherst — has shown that the empirical study by two Harvard professors frequently cited in support of debt-reduction policies is riddled with errors.6

The political decision-makers of recent years have no excuse. The failure of austerity policies is today patent. But it was also widely predicted, including among a large section of the public, for example with the 2010 publication of the Manifeste des économistes atterrés.

The limits of monetary policy

The choice to reduce public spending has had the counterpart of leaving central banks to their own devices on the macroeconomic front. Charged with freeing up credit in order to stimulate economic activity, they have displayed an extraordinary activism. First of all, they drastically reduced their key lending rates. These last two years several of them — the ECB, Bank of Japan, and Swiss National Bank included — have even ventured into the unchartered territory of deciding in favour of negative rates.7 In parallel to this, central banks have deployed new instruments such as quantitative easing, which consists of buying public and private debt securities on the secondary market in order to push down their yields. To this end the main central banks have created massive volumes of currency, tripling their combined balance sheets from $6,000bn in 2008 to close to $17,500bn today.8 These extremely powerful policies partly did produce the expected financial effects. Government securities’ long-term interest rates have fallen spectacularly (Figure 2). This means that public debt has become free, or even allows the state to earn money. Thus in December 2016 the interest rate that investors demanded to buy 5-year French debt was negative (around -0.28%) and 10-year debt around 0.65%, whereas the yearly increase in consumer prices stood at 0.7%. In such a conjuncture, and without even taking into account the small GDP growth that itself swells tax receipts, this means that the state is getting richer as it gets more indebted. In short, "Now is the time to borrow, and to borrow long-term." Alas, it was not the French economy minister Michel Sapin who pronounced these words, but Donald Trump a few months before he was elected president…9

Figure 2: Long-term interest rates, Japan, USA, Eurozone

Central bank action, and in particular the long-belated action taken by the ECB, has weakened the speculation on sovereign debts that was the origin of the Eurozone crisis. Yet the goal, here, is not to support public investment, or to finance jobs. The proof is that in Europe the eligibility of public debt for the ECB buy-up programme is conditional — for the countries under Troika assistance — upon their submission to deficit reduction requirements. Quantitative easing is just one further addition to the panoply of instruments created by central bankers in order to reduce the cost of credit and thus stimulate private indebtedness, reinvigorating investment and growth. This monetary policy has allowed a gradual revival in banks’ activity, and breathed air into the stock exchanges. Thus in 2014 global stock-market capitalisation surpassed its 2007 peak, with the collateral effect of aggravating wealth inequality a little further. But investment did not get going again.

A bargain for shareholders

Companies have well understood the godsend that low interest rates represent. As central bankers expected, enterprises took on more debt with banks and, even more so, the markets. In the United States the total amount of bonds has more than quadrupled since 2007. Firms’ total debt has increased considerably during this period, passing from $6,000bn to $8,400bn between 2010 and 2016. At first the rise in Europe was rather more modest, but it rapidly accelerated in 2016 when the ECB drove higher levels of quantitative easing. What do companies do with these borrowed funds? A note published by the Edmond de Rothschild group in October 2016 gives specific clarification on this point: "Companies have used their resources for two other purposes: to increase dividends first and then to buy back shares. Shareholders benefit from both of these actions, as dividends provide them with income and share buybacks boost share prices. Buybacks not only serve to lift share prices, they also improve companies’ earnings per share (since they reduce the amount of shares on the market)."10

In the United States this is unambiguously the case. Since 2014, share buybacks have exceeded $500bn a year, and dividends $600bn, again reaching the record payment levels seen on the financial markets of the 2000s. As for Europe, the initial data regarding the effects of the ECB’s asset repurchase programme point in the same direction: the abundant credit for firms means profits for shareholders, but does not translate into a recovery in investment.

At the macroeconomic level, austerity policies and companies’ refusal to extend their operations have translated into a real stalling of investment. In the main economies, gross fixed capital formation fell by 2 to 3 percent of GDP between the pre- and post-2007 periods. When we look at net investment — that is to say, taking into account the erosion and attrition of existing capital, the dynamic takes a dramatic turn (Figure 3). For each dollar of income in the United States, no more than 4 cents are invested, 2 cents per euro in the Eurozone, and almost nothing in Japan. This means that these economies are making very scant preparations for the generations to come. In certain countries like Italy and Greece, we are even seeing an involution, since the fixed capital stock has been falling for several years, in the latter country reaching the terrifying rhythm of a yearly 7 to 8% fall.

Figure 3: Net investment, Japan, USA, Eurozone 12

The possibility of a crisis

The ultra-lax monetary policy followed up till 2016 allowed for the preservation of the fictitious capital accumulated on the financial markets. While this situation has not degenerated into a generalised depression, nor has it broken out of stagnation — and already, fresh cracks are showing.

A first series of weaknesses directly results from this monetary policy’s success. Reducing interest rates has had the collateral effect of reducing yields on the most reliable assets, which make up a very large proportion of the portfolios of pension funds, life insurance and part of the banking system. This dynamic has aggravated the latent but generalised crisis of pensions in all the countries where funded pension schemes are predominant. On 16 December, for the first time the US Treasury approved the cuts proposed by a pension fund, namely the ironworkers’ fund based in Cleveland. If this process reaches its planned conclusion this will translate into a 20% average decrease in the pensions paid out — but in some more severe cases, depending on individuals’ situations, there will be a decrease of up to 60%. The managers of the fund in charge of 34,000 New York State truck drivers’ pensions have also proposed a 20% cut. In the Netherlands, several funds will trim payments from this year onward, while in Great Britain, where the big firms’ pension system deficit tripled in 2016, these firms are pressuring the government to let them reduce their legal obligations to their employees.

Returning to a more restrictive monetary policy is thus no solution, for the integrity of the long chains of debt criss-crossing our economies is ever more dependent on low interest rates. A decade after the crisis, economic agents remain highly indebted, and if the rate rises in the United States were to accelerate this would cause just as rapid a rise in credit defaults — one liable to contaminate the financial system and then the economy as a whole. The low rates of recent years have also pushed investors to acquire more and more risky assets, which has fed bubbles that would rapidly burst if rates suddenly rose. As the main US bosses’ think-tank the American Enterprise Institute explains, this is indeed an alarming situation: "A dangerous combination of a high global debt level, the gross mispricing of global credit risk, weak banks of systemic importance, and global economic fault lines [like Brexit, the Chinese slowdown and the rampant banking crisis in the Eurozone] make it all too likely that the world is headed for a global economic and financial crisis."11

Breaking out of austerity, a headache for conservatives

The OECD agrees that macro-economic strategy has to change: "monetary policy has been over-burdened and there is now a premium on getting fiscal levers pulled in the right way." This is the broad orientation of the turn that began with the arrival in power of Theresa May and then Donald Trump. But the equation that these latter have to resolve is not so simple, since conservative politicians and the agencies managing capitalism as a system have serious reasons to prefer austerity. As the economist Michal Kalecki noted already in the 1940s, "The social function of the doctrine of 'sound finance' is to make the level of employment dependent on the state of confidence." This doctrine is a useful one for business circles, for it means that any policy that contradicts their interests is immediately punished by a fall in investment and employment. Yet as the experiences of the socialist countries, Roosevelt’s New Deal, the French planning of the 1950s and the war economies all show, a government can indeed always stimulate growth up to the point of full employment, on condition that it assures that imports are covered by exports. If most of the time "economic experts" linked to finance and industry rule out such a possibility, they do so for political reasons. They reject any extension of the state’s field of competences, since in their eyes that would entail an unacceptable encroachment upon the sovereignty that capital reconquered through a hard-fought struggle over the last few decades.

Nonetheless, the different segments of capital cannot be satisfied with monetary policy’s inability to reactivate accumulation. The gamble that favourable monetary conditions would allow a revival of economic activity has now failed. The central banks have offered nothing but a pale imitation of economic health, a pseudo-validation of the financial markets’ hopes, which risks transforming into a general crisis yet more powerful than the last one. If we add to this the mounting political tensions, then giving up on achieving balanced budgets in the short term — as the British Chancellor of the Exchequer hurried to do after the Brexit vote — is not such a big deal. That is also what conservatives in the US Congress have in mind; even though they are hostile to public deficits, they must now accommodate to a president who proclaims himself "the King of Debt." The contours of the emerging policy mix have not yet been fixed, but it does now seem that we can say that governments are rediscovering the virtues of public deficits.

The return of monopoly capitalism

Beyond the macroeconomic conjuncture, the years between the 2007 crisis and today have also accelerated a qualitative change toward greater economic concentration. The biggest firms have profited from the mass of low-cost liquidity that was made available to them, multiplying their merger and acquisition operations. In 2015 and 2016 these operations surpassed the historic records reached before the crisis. They have primarily concerned the pharmaceutical industry, the technology sector but also the consumer goods sector. For example, last year the world’s two biggest brewers merged, with Anheuser-Busch InBev (Leffe, Stella, Corona, Budweiser, Hoegaarden, Becks…) buying out South Africa’s SAB Miller for £67bn, making it the third biggest acquisition in history. For the firms concerned, these operations allow them to get rid of redundant jobs and to increase the market share they control. Beyond reduced costs, successful mergers bring a long-term increase in profits, because they expand companies’ customer base and improve their market power relative to their suppliers. Seeking to satisfy their shareholders, big companies are thus transforming into unassailable economic fortresses.

In a report published in April 2016, president Obama’s Council of Economic Advisers expressed its concern over the risks of increased concentration in the US economy.13 It noted a strong decrease in the number of companies being created, even as the rate at which they expired remained constant, as well as a rise in collusion verdicts in anti-trust cases. One particularly impressive fact is that the return on investment among the 10% of best-performing firms is today five times higher than the median level among big firms, while 25 years ago it was only two times higher. This development indicates an extreme concentration of profits in the hands of the biggest of the US economy’s big firms.

As The Economist notes, this concentration is also taking place among shareholders.14 Gigantic institutional investors like Black Rock, State Street and Capital Group together control 10 to 20% of most big US companies, including those directly in competition with one another. These shareholders impose uniform strategies seeking to maximise short-term returns while limiting investment, which would mean intensified competition. Other factors for the concentration of economic power come from the barriers to innovation connected to the proliferation of patents, the advantages associated with the accumulation of data — giving rise to the giants of the digital economy — and the increased role of regulation in competition among capitalists.15 Thus spending on lobbying constantly rises, reflecting the cumulative competitive advantage offered to the most powerful firms by their capacity to push for the adoption of rules favourable to their own activities.

This increased economic concentration is a plausible explanation for the strangeness of the current economic situation. Firms are gorged on liquidity — with more than $800bn in cash available in the United States — but they are not investing. One of the leading Marxist economists of the twentieth century, Paul Sweezy, spent his life analysing the bases of monopoly capitalism.16 His central thesis is that monopolisation feeds and stagnation: in a state of oligopoly, firms receive such great volumes of guaranteed profit flows that there are no equally advantageous opportunities to invest; they thus divert a growing proportion of the surplus from the productive sphere towards the chimeras of finance, feeding a repeated series of bubbles, stagnation and endemic unemployment. Without doubt, Sweezy’s argument is more relevant than ever. It indicates that beyond the mix of devastating economic policies since 2010, the current stagnation has far more powerful motives, owing to the organisation of contemporary capitalism itself.

Like the 1930s or 1970s, the 2010s are a pivotal decade. This is, in regulation school economists’ terms, a great crisis; that is, a period of turbulence in which the difficulties internal to capitalism’s dynamic and social contradictions can only be overcome at the political level, through fundamental institutional changes. These transition phases between two modes of societies’ existence are marked by very great indeterminacy. The invalidation of the previously-existing arrangements generates instability and fluidity, and it drives a form of radicalisation of social actors seeking a way out of the status quo. We find ourselves in precisely such a historical moment.

The attempts to restore the neoliberal and financialised regime that prevailed between the 1980s and 2008 by way of special monetary policies have proven fruitless, while the risks of a new financial conflagration have built up. For the Left, this conjuncture does certainly offer opportunities, but it is also pregnant with threats. If, after decades of retreat, the anti-liberal political Left is today emerging from its marginal role in the Western world, it must now fight two adversaries; on the one hand the disciples of market fundamentalism, and on the other the disciples of a nationalist authoritarianism. Ready to challenge austerity and free trade, today these latter see an ally in the government of the world’s leading economic power.

Notes:

1. IMF, "Fiscal Implications of the Global Economic and Financial Crisis," Occasional Paper No. 269, September 18, 2009.

2. Declaration of the Summit on Financial Markets and the World Economy November 15, 2008, Washington DC, http://www.un.org/ga/president/63/commission/declarationG20.pdf

3. Between 2007 and 2012, the OECD’s average error, in the projections it made each May for the following year, stood at 1.5%. A chasm. OECD (2014), "OECD forecasts during and after the financial crisis: A Post Mortem," OECD Economics Department Policy Notes, No. 23 February 2014.

4. Olli Rehn, "Why Europe is cutting spending," Wall Street Journal, June 25 2010. http://www.wsj.com/articles/SB10001424052748704911704575326421944964834

5. Mark Blyth, Austerity: The History of a Dangerous Idea, Oxford University Press, 2012.

6. Robert Pollin and Michael Ash, "Austerity after Reinhart and Rogoff," Financial Times, April 17 2013, https://www.ft.com/content/9e5107f8-a75c-11e2-9fbe-00144feabdc0

7. Cédric Durand, "Le capital sans XXIème siècle," La revue du Crieur, October 2016.

8. Desmond Lachman, "Trouble ahead for the global economy," The American Enterprise Institute, November 10 2016 https://www.aei.org/publication/trouble-ahead-for-the-global-economy/

9. "'King of debt' Donald Trump: 'Now is the time to borrow'," CNBC, 11 August 2016. http://www.cnbc.com/2016/08/11/king-of-debt-donald-trump-now-is-the-time-to-borrow.html. We might however note that Trump’s remarks on this like so many other topics have been rather inconsistent.

10. Banque Edmond de Rothschild, "Share buybacks and dividends: Will Eurozone companies follow in the footsteps of their US counterparts?," Economic Outlook, 05/10/2016. http://www.edmond-de-rothschild.com/site/International/en/news/economic-outlook/7757-share-buybacks-and-dividends-will-eurozone-companies-follow-in-the-footsteps-of-their-us-counterparts

11. Desmond Lachman op. cit.

12. Michal Kalecki, "Political aspects of full employment," The political Quarterly, 14 (4) October 1943, p. 325.

13. Council of Economic Advisers Issue Brief, "Benefits of Competition and Indicators of Market Power," April 2016.

https://www.whitehouse.gov/sites/default/files/page/files/20160502_competition_issue_brief_updated_cea.pdf

14. The Economist, "Too much of a good thing," March 26, 2016. http://www.economist.com/news/briefing/21695385-profits-are-too-high-america-needs-giant-dose-competition-too-much-good-thing

15. On this, see Benjamin Coriat, "La crise de l’idéologie propriétaire et le retour des communs," Contretempsweb, 27 May 2010. https://www.contretemps.eu/crise-lideologie-proprietaire-retour-communs/

16. The book Sweezy co-wrote with Paul Baran is Monopoly Capital: An Essay on the American Economic and Social Order, Monthly Review Press, 1966.