Sellouts in the Room: Éric Toussaint on the Greek Debt Crisis and Syriza Capitulation

Éric Toussaint, the spokesman of the Committee for the Abolition of Illegitimate Debt (CADTM) and scientific director of the Greek Debt Truth Audit Commission, describes the findings of the commission and the legal avenues available to Greece for the repudiation of a significant portion of its debt.

First published at CADTM.

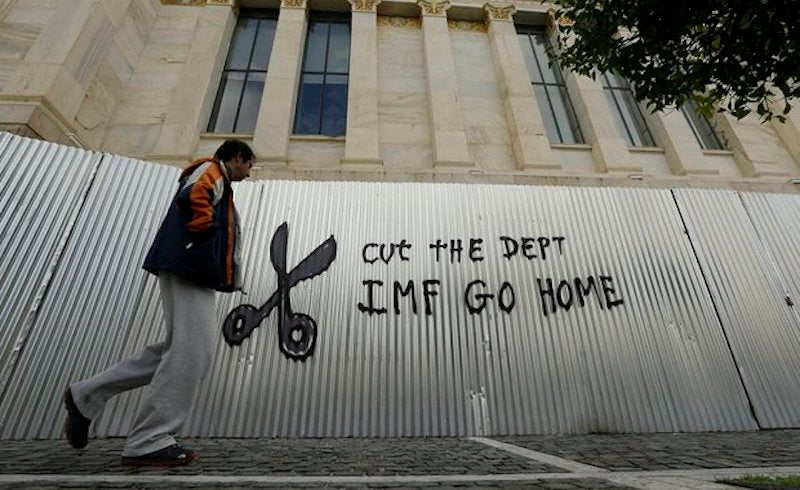

For years, throughout the severe economic crisis that has plagued Greece over much of the past decade, the international media and financial press have held Greece up as a striking example of financial folly and mismanagement. Greece’s debt, we have been told, is the product of fiscal irresponsibility, of “lazy” and “unproductive” Greeks living beyond their means and spending recklessly. Moreover, Greece has been chastised for not emerging out of its economic doldrums despite being the recipient of hundreds of billions of euros worth of “free bailout money.” In short, Greece has been presented as an example for other countries to avoid at all costs.

Éric Toussaint, the spokesman of the Brussels-based Committee for the Abolition of Illegitimate Debt (CADTM) and scientific director of the Greek Debt Truth Audit Commission, adopts a radically different view.

In an interview that initially aired on Dialogos Radio in December 2017, Toussaint describes the findings of the commission and describes the legal avenues available to Greece for the repudiation of a significant portion of its debt, which he describes as odious and illegitimate. He also criticizes claims made by economist and former Greek Finance Minister Yanis Varoufakis in his recent book regarding the supposed lack of options available to Greece in its negotiations with its lenders in 2015.

Toussaint illustrates the capitulation current Greek Prime Minister Alexis Tsipras, resulting in further harsh austerity measures and no solution for the issue of the Greek public debt.

You recently wrote a three-part series of articles looking at the actions of, on the one hand, the Syriza-led government in Greece under Prime Minister Alexis Tsipras and, on the other hand, the actions of Yanis Varoufakis, the well-known economist and Greece’s finance minister under the Syriza-led government in the first half of 2015. Your critique comes following the publication of Varoufakis’ recent book, Adults In The Room, in which Varoufakis gives his account of the Greek crisis and his actions in supposedly standing up to the "troika" (the European Commission, the European Central Bank, and the International Monetary Fund. We’ll use this as a starting off point for our discussion. What were your general impressions of the book?

The book really should be read, because it’s a very useful testimony about what happened. I disagree with the orientation of Varoufakis, but it’s a unique presentation of what happened before the Greek parliamentary election of January 2015 and what happened in the first six months thereafter — leading to the capitulation of the Syriza government in July 2015, following its overturning of the result of the July 5 referendum rejecting a new German-backed austerity plan.

In Adults In The Room, one of the claims apparently made by Varoufakis is that Greece was bankrupt in 2009 and that this set the stage for the so-called “bailouts” and austerity that followed. You dispute this claim, however. What do the facts show?

In reality, the main problem was on the side of the private debt, the debt of the Greek banks, but also other businesses and households. There had been a process of huge growth of the private debt just after the integration of Greece into the Eurozone, because the big French, German, Dutch, and Belgian banks wanted to lend money to Greece, knowing that there was no risk of devaluation because of the monetary union.

They had a surplus of liquidity before the crisis of 2007–08, and after the crisis because, as you will remember, the Federal Reserve of the U.S. and the European Central Bank injected a huge amount of liquidity into the banks. These banks used that money to lend where they were having the better profits, and the countries of the “periphery” — like Greece but also Portugal, Ireland, and Spain — were more profitable than countries like Germany, France, Benelux, the U.K. or the U.S.

So the main issue was the problem of the bubble of private credit, but the main problem of the Greek government of George Papandreou in 2009, and the problem of the French government of Nicolas Sarkozy and the government of Angela Merkel in Germany, was that it was impossible to tell voters that we have to once more bail out the private banks. Therefore, it was necessary for them to build a fake narrative of what was happening in Greece, telling the public that the main problem was the huge level of public debt and the incapacity of the Greek government to keep on financing its public and external debt. In reality, they created this fake narrative to convince public opinion about the need to give money to the Greek government to “bail out” the Greek private banks and the French and German and Dutch and Belgian private sector, mainly the banks.

So, I disagree with the dominant narrative and I disagree with Varoufakis, who wrote in his book that the Greek state was bankrupt. I think the main problem was the banks, and the Greek government had the choice to either bail out the private sector or to “bail in” and socialize the banks (forcing the banks to take losses). It ultimately decided not to socialize or to expropriate the private banks. It was an error of the Greek government, and the other European governments were accomplices, along with big financial capital.

In summary, there is a difference between what Varoufakis is saying and what I am saying, and the conclusions are also different. I would say that what the Greek government should have done would have been to suspend the payment of the external debt, including the public debt. Varoufakis is saying the Greek state should have recognized itself that it was bankrupt and should have sold public assets to the foreign private sector, including selling to the other European countries and investors, and to the Greek banks. Do you see the difference?

Much has been said about Greece falsifying economic figures to enter the Eurozone, but you point out in your articles that Greece’s debt and deficit statistics were falsified by the Papandreou government in 2009 and 2010 and by IMF employee Andreas Georgiou, who was placed in charge of the Greek Statistical Authority (ELSTAT) by the Papandreou government. How were the Greek debt and deficit figures falsified, and is this something that Varoufakis addresses in his book?

No, he says absolutely nothing about this falsification. But this falsification is evident. There is the case of Andreas Georgiou, the director of ELSTAT, who was sued, and at the beginning of August 2017 was found guilty of falsification by the Greek courts.

What happened? Papandreou met with the leaders of the European Central Bank — at that time it was Jean-Claude Trichet, very linked to the French banks — and the IMF, whose general director at that time, Dominique Strauss-Kahn, was also very linked to the French banks. The Papandreou government asked the director of ELSTAT to add some debt to the official public debt. At the first step, Eurostat, the European organization of statistics, told ELSTAT that it was an error to add this debt, but Eurostat was afterward also convinced by Trichet and by José Manuel Barroso, then the president of the European Commission, to be part of the falsification of the Greek public debt.

I would estimate they increased the debt more or less 15 to 20 percent in relation to the Greek GDP, so that the official figure reached the huge ratio of 125 percent of GDP for the public debt, and the budgetary fiscal deficit reached something like 13 percent. So with these figures, the troika could say there is an emergency, we have to intervene to “help” the Greek government, with 110 billion euros of loans to Greece. So in this case, I would say that it was a conspiracy. I am not a conspiracist, but in this case we really now have the proof of a huge level of falsification and of the building of the fake narrative to misrepresent what was the real situation.

You point out that Yanis Varoufakis, despite his radical and leftist profile, maintained friendships and close contact with such figures as the head of the Greek conservative party, Antonis Samaras, who was prime minister of Greece between 2012 and 2014; Yannis Stournaras, who was the finance minister under the Samaras government during that period and who is the current governor of the Bank of Greece; and George Papandreou, who led Greece into the austerity and memorandum regime in 2009 and 2010. Describe the nature of Varoufakis’ relationships with these figures.

You know, Varoufakis is very happy to share that he has developed and maintains many relations with the traditional political class in Greece. In some ways, when you read his book you see that he is trying to convince world leaders that what he was proposing was a better solution for everybody, including for the leaders of the world. And so he insisted on stating that [then-leader of the Greek opposition] Antonis Samaras called him one evening after [Varoufakis] publicly criticized what Papandreou was doing, with Samaras telling Varoufakis “I don’t know you but I like very much what you said on Greek television and to Greek public opinion.”

It shows that Varoufakis has a very complicated personality, because he says he wants to be at the side of the oppressed people, and he’s promised to his voters not to betray them, but at the same time he wanted to convince world leaders and to maintain very good relations with everybody — with Stournaras, with Samaras, with Papandreou, with Christine Lagarde, with [then-German finance minister Wolfgang] Schäuble, with [German Chancellor] Merkel. And in the U.S., if you read the book, he says he was very happy to maintain a very good relationship with Larry Summers and Jeffrey Sachs.

People in the U.S. should know who these guys are. Larry Summers was in charge of the U.S. Treasury in the Clinton administration at the end of the 1990s and he was responsible for the revocation of the Glass-Steagall Act [that had been a way of protecting the economy from unduly risky behavior by banks]. After that he was the president of Harvard University and was totally macho in his declaration of the difference between men and women. Asked why there are so few women in senior positions in the scientific field he claimed that women are naturally less gifted for scientific studies than men and swept aside possible explanations based on family or social background, or on discrimination. See : http://www.cadtm.org/Economy-Obama-chooses-those-who

He can be fairly described as a right-wing Democrat. Sachs, who was also a friend of Varoufakis, was responsible for the first economic “shock therapy” [harsh and sudden economic austerity policies] imposed on Bolivia in 1985, and the “shock therapy” imposed on Russia and Poland in the early 1990s. So it’s really problematic to see this contradictory posture of Varoufakis.

In his book, Varoufakis goes on to say that he convinced Syriza to depart from its policy platform of 2012 and the Thessaloniki platform of 2014. Instead, Varoufakis convinced Syriza to adopt his own set of economic proposals. For instance, Varoufakis seems to have proposed advocating for a debt restructuring instead of a debt reduction. What was Syriza originally proposing; what were Varoufakis’ proposals which were ultimately adopted; and why were Varoufakis’ proposals, in your words, doomed to fail?

In the electoral campaign of 2012, Syriza succeeded in increasing its popular support. In the election of 2009 Syriza received 4 percent of the vote, and in June 2012 26.5 percent of the vote. So it was very clear with the election of June 2012 that sometime in the future Syriza would become the government of Greece. And they gained such popular support in 2012 with a program that was very radical.

They were saying that if you elect us as government, we will suspend the payment of the debt and we will audit the debt to identify the illegitimate part of the Greek debt. They also said we will socialize or nationalize the Greek banks. And they said that they would put in practice a very radical fiscal policy and increase the taxes on the rich, the Orthodox Church, and the oligarchs who are active in the shipping industry. So it was a radical program, and they also said that we will not make any more sacrifices for the euro.

Varoufakis was opposed to this orientation, and in his book he explains how he succeeded in convincing Alexis Tsipras and his inner circle to moderate, to soften the program and to say that it was not necessary to suspend the payment of the debt — that it was possible to convince the creditors to restructure the debt without reducing the stock of the debt and without a suspension of payments. Varoufakis also wrote that he convinced Tsipras that it was important not to increase the taxes paid by the private sector, the Greek corporations and financial industry, and foreign corporations based in Greece.

What I can say as a comment on Varoufakis’ book is that Tsipras, after the election of June 2012, was also looking for people like Varoufakis, who could help Tsipras to soften the program of Syriza while not openly confronting the rest of Syriza's leadership. So I would say Tsipras and Varoufakis organized something like a shadow cabinet within Syriza to prepare another official platform. Varoufakis explains that actually they did this against the official line of Syriza. For me, at this level, Varoufakis has a huge responsibility for the capitulation that happened at the beginning of July 2015.

One of Varoufakis’ proposals to the leaders of Syriza was to accept a primary budget surplus of up to 1.5 percent of GDP. For those unfamiliar with economics, what is a primary budget surplus and why is it harmful for a country whose economy is in a depressed state, as is the case in Greece?

To achieve a primary budget surplus, you need to cut expenses, and it is clear that the type of expenses to be cut are social expenses and infrastructure investment. A primary surplus is achieved prior to paying the debt. When you say that I will guarantee as a government a primary surplus, it is to use this surplus to pay the debt. You will not question the payment of the debt when you guarantee a primary surplus.

The alternative would have been to say, as a legitimate leftist government, we should have a fiscal deficit, because we should use the money of the government to stimulate the recovery of the economic activity and we should improve the quality of life of the population — and to accomplish this we need more money for health, for education, to create jobs. And so, the proposal of Varoufakis was at odds with a truly radical negotiating position on the part of the Greek government.

Yanis Varoufakis and Alexis Tsipras have spoken, for instance, at the Brookings Institution, the well-known neoliberal Washington think tank. Can such actions, in your opinion, be reconciled with their supposedly leftist and radical image?

I would say it is not really shocking. Personally I don’t like to do such things, but we can understand that certain people want to be in government and are therefore willing to give some speeches to different publics. But at the same time it is absolutely clear that Tsipras prioritized his being invited by institutional authorities who are neoliberal, and he did that and he has kept on doing that because he wants absolutely to be recognized as a political leader, one who is very responsible to the markets and to the stability of the financial system.

In the case of Varoufakis, he wanted to create, I would say, a more complex image — in some way provoking but in some way saying yes, we need to reach a compromise, an agreement. And he also gave an absolute priority to invitations from right-wing or systemic institutions. It’s very clear, for instance, that he liked very much the conservative leadership in the U.K. and accepted several invitations from them; and he also accepted, precisely at the beginning of his tenure as finance minister, an invitation to go to London to give a speech to foreign investors. It showed, in this way, that he and Tsipras were the main interlocutors with creditors and capitalists. In Varoufakis’ book, he also writes a lot about the good relations he tried to build with China and Chinese authorities investing in Greece.

You have been the scientific coordinator of the Greek Debt Truth Commission since it was established in 2015. Has the Syriza-led government shown any intention of adopting the findings of the commission, and was there any point during your participation on the commission when you realized that perhaps the Syriza government’s policies were going in a different direction from the work that you were doing?

I would say that frankly, since the beginning, when I spoke with the then-president of the Hellenic Parliament Zoe Konstantopoulou on February 16, 2015, I told her that I came to you, came to the parliament to make a proposal to you to launch an audit commission, and I can convince people from 10 different countries to work with no payment in favor of the Greek people and in favor of the truth about the debt. Telling that to Zoe [Konstantopoulou], I added that I was convinced that Alexis Tsipras would not be enthusiastic about that proposal. She told me, “No problem, I will do that, I will call Alexis and I will convince him.” She immediately issued a press release regarding our meeting on February 16, 2015. She also called Tsipras, and Tsipras officially told her “do it, it’s part of our program; do it and do it with Eric Toussaint."

We held the first meeting of the commission on April 4, 2015 in the Greek parliament. Alexis Tsipras came at the beginning of the inaugural session. The president of the Hellenic Republic, Prokopis Pavlopoulos, came also, and so officially they showed their support. Almost all the members of the government also attended, including Varoufakis. But it was clear to me that Varoufakis was not in favor of freely supporting the commission, and the same from Tsipras. Zoe Konstantopoulou was convinced, because she was a political friend and a friend of Tsipras, that he was sincere when he was telling her that he wanted to support our work. See the narration by Zoe K. here.

Several weeks later, it was very clear that neither Tsipras or Varoufakis were open to publicly, in front of the media, mentioning the work of the commission. They never — you know, they traveled a lot to Brussels and Varoufakis traveled a lot to Washington to meet Christine Lagarde, the general director of the IMF — and they never questioned the legitimacy of the debt. So for me it was very clear that they were in some way forced by the president of the Greek parliament to express official support, but at the same time it was very clear that they didn’t want to radicalize their position.

I performed this work with the 30 members of the commission. The work done by the commission, I would say, consists of more than 1500 or 2000 hours of work performed over eight weeks among 30 persons. We worked day and night to produce a very efficient and rigorous report, and my expectation was that there was some possibility that several ministers of the Syriza-led government — ministers of the then-Syriza faction “Left Platform,” jointly with Zoe Konstantopoulou and the pressure from the streets and from the other radical-left groups and the trade-union left — could pressure the government to use our work. But I was not really very optimistic because I was very well informed about what Varoufakis was doing with his team of advisers. I was receiving clear information about the concessions that he was ready to give to the creditors.

But I don’t regret having done this work, and people who participated in the commission — people from France, Spain, Greece, Ecuador, Brazil, the U.K., Cyprus, Belgium and Zambia — these people are very proud to have done this work. They are convinced that because we have done very serious work, it will be useful in the future — in Greece but also in other parts of the world, because in Spain, in Portugal, in Italy, in Slovenia, in other countries, people are reading our report, are asking us a lot of questions, trying to implement the same methodology to the specific case in their own country. I’m sure it will be useful.

Describe the findings and conclusions that were published in your report, and also the recommendations made by the Debt Truth Audit Commission.

In the first two chapters, we analyze the building of the Greek public and private debt before the crisis. We explain what happened in the 1990s and in the first decade of the 21st century. We showed that the accumulation of debt was linked to huge amounts of military expenses encouraged by the U.S. government and the French and German governments, which are the main sellers of weapons to Greece. We showed also that interest rates paid by Greece at the end of the 20th century increased the debt, as also happened with other peripheral countries.

Additionally we showed the responsibility of the previous PASOK and New Democracy governments in giving tax gifts to the rich that reduced the government revenue and forced the government to finance its budget by debt. And we showed also that the debt increased after the addition of the Greece to the Eurozone, because a lot of money came from the German and French investors and banks.

Following that, in chapters 3 and 4, we showed the transformation of the debt from the troika’s first memorandum, when the private lenders were replaced by public lenders — the troika, the European Commission, 14 different states of the Eurozone, the IMF and the European Central Bank. We showed that they did that to bail out the private banks — foreign and national — and not in the interest of the people. We demonstrated that the lenders added conditions to the new loans, conditions that violated international treaties on economic, social, cultural, civil, and political rights.

In other words, we demonstrated that the debt to the troika was an odious debt, meaning a debt accumulated against the interests of the people, and that the creditors or lenders knew that they were giving loans against the interests of the people. And, in the case of the troika, this was absolutely evident, because the troika was dictating to the Greek government the terms of the loans — which laws to change, which new laws to adopt, what wage and pension reductions and privatizations to enact. The troika were not only accomplices but they were direct commanders — they were the initiators of these violations.

After that in the report we demonstrated the clear impact on the quality of life of the Greek population. In chapter 5, we named concrete international treaties and which article is being violated by the conditions imposed by the troika. And in the last two chapters we explained in legal terms why the Greek debt to the troika should be rejected as illegitimate, odious, illegal, and unsustainable.

Our conclusion was that the Greek government fully has the right to suspend the payment of the debt, to question the debt, and also to repudiate the part of the debt identified as odious. Notable lawyers helped us, as members of the commission, to write the conclusion based on international law and Greek domestic law. It is clear that should Varoufakis and Tsipras have used this report, they would have had very strong arguments against the creditors, instead of capitulating in front of them in July 2015.

Is the Greek Debt Truth Audit Commission still active today? And, by extension, how is the CADTM active today on the issue of the Greek debt?

The Debt Truth Commission was dissolved by the new president of the Greek parliament, Nikos Voutsis, in October 2015. We were opposed to its dissolution, and so we decided collectively to transform ourselves into an independent organization with the same name. We are active now as the Debt Truth Committee, recognized by Greek law, and we have met several times in the past two years.

We met once in the European Parliament, invited by several members of the European Parliament — French, Greek, German, and Spanish European MPs who are supporting our work. We held several meetings in Greece, not in the parliament because we are no longer invited, but in the office of the Greek Association of Lawyers. There were many Greek citizens who attended the public part of our meetings.

Several of us have published different articles. I published a book in Greek last July with new material about the Greek debt. We also produced several videos and a documentary, Audit, a 26 minute film. It is very interesting, I recommend to you to view it. I have to check, but I think that very soon it will be available with English subtitles. So we are keeping on with our work. It is clear that we are not supported by the government. And the right-wing press maintains silence about our work — but we enjoy significant support in the Greek social movements and radical-left organizations.

In looking at Greece over the years of the economic crisis, we’ve often heard that Greece has been given all this money by the troika, insinuating that the money was simply given away to Greece. In reality though, where have most of the so-called “bailout” funds ended up?

It’s absolutely clear that more than 90 percent of the loans given to Greece went back outside of Greece to pay back the private banks and public creditors, or to bail out the Greek banks. Less than 10 percent has been used by the regular government as an input to the budget, but they used even that to promote the neoliberal policies! So this money also was used against the interests of the Greek people, because it was used to finance privatizations, to finance the layoffs of thousands of public servants, et cetera.

What options does Greece have available to it under domestic law, European law, and international law today — with regards to the public debt, and also with regards to the potential abolition or overturning of the austerity measures and memorandum-related policies, such as privatizations, that have followed?

There is something very concrete that could be done with the Greek bonds owned by the European Central Bank. The ECB bought Greek bonds in 2010, 2011, and 2012 at a discount price, a discount of 30 percent. After that, after the “haircut” [downward revaluation of Greek bonds] of 2012, the ECB refused to be part of the “haircut.” Now the ECB is demanding that Greece repay the full amount of the Greek bonds the ECB bought at a discount price. It is demanding the full nominal value of the bonds — and with a very high interest rate, 6.5 percent — at the same time that the ECB is lending money to the private banks at zero interest.

What the Greek government could do is to change the legal status of the Greek bonds, because they are still covered under the legal jurisdiction of Greece. The Greek government could say we are enacting a haircut of 50 or 80 percent on these bonds, to reduce the payments, because we want to use the money in favor of the Greek people’s interests. It would be possible to do that. Tsipras can do that or a future Greek government can do that.

What should complement this, what a government that would like to really help the Greek people’s interests would be to, on the basis of our audit, enact another unilateral, sovereign action of repudiation of other parts of the debt. It is clear that this would provoke a huge verbal reaction. But for the past seven years, since the first memorandum of 2010, the creditors have criticized the Greek government and the Greek population, shown the Greek population as “lazy” and as “delinquent” at the level of tax payments. I think that they cannot, as creditors, inflict more pain on the Greek people than they already have.

A legitimate government can affirm the popular sovereignty in the interests of the Greek population, can resolve an issue in favor of the general interest of the population — and not only the Greek people’s interests, but humanity, I would say. We need justice, and if there is no justice for the Greek people, there will be no justice for all the people in Europe and the rest of the world. We have to launch and to expand the struggle to oppose illegitimate and odious debt all over the world.

Debt, as you say, is not just a Greek or European problem. Total world debt is said to surpass $230 trillion dollars. Is the current global economic model sustainable under such conditions, in your view?

No, it’s not sustainable. As you certainly know, recently the IMF but also the Bank of International Settlements — it is a bank of the big central banks based in Basel, Switzerland — have been saying there are new financial bubbles. These bubbles have been provoked by an inflation of the price of assets, with a massive injection of liquidity decided by the big central banks like the U.S. Federal Reserve, the European Central Bank, and the Bank of England.

In the next months or years this will provoke a new financial crisis. Exactly when it will happen we don’t know. It can happen in one week or in six months or in one year. Certainly it will happen with a stock exchange crash, and a crash on the market of obligations emitted by private corporations and also sovereign debt. Where it will explode — Wall Street, Paris, Frankfurt — we don’t know. Maybe Beijing. But it will explode in the near future.

This model of huge global debt, which is accumulated in favor of speculative activities and to enrich the richest, will end via a new general crisis. Not a terminal crisis of capitalism, because the structure of capitalism has survived such financial crises since the beginning of the 19th century.

But these types of crises generally deliver a huge amount of pain to the majority of the population, so we should be conscious of what capitalism is preparing for the population of the world. We have to combine a struggle against illegitimate debt with other demands about private banks, about taxes, against climate change, in favor of social justice. We need to chart a radical turn opposing the capitalist model.

[book-strip index="1" style="display"]